STOCK TAKE | Heineken keeps it green, Godongwana chooses his words carefully, and what are the trends for a tax revolt? | Fin24

[ad_1]

OPINION

Heineken retains it inexperienced

Beer after finishing your snake relocations? Sounds good

Market commentators and journalists typically speak fairly glibly about corporations creating photo voltaic vegetation and different renewable vitality tasks to cut back their dependence on Eskom. It’s because it if is merely a case of throwing collectively a couple of panels and urgent the launch button, when in actual fact much more goes into these developments than is realised. This was illustrated to nice impact this week by the South African unit of Dutch brewing large Heineken when it formally unveiled its 6.5MW photo voltaic plant, which can provide virtually a 3rd of its electrical energy wants at its Sedibeng brewery in Midvaal.

The plant, which is Heineken South Africa’s largest inexperienced vitality undertaking thus far within the nation, is a part of the worldwide group’s dedication that its breweries have to be carbon impartial by 2030 by way of manufacturing, and impartial by way of their worth chain by 2040.

Constructed by renewable vitality group Sola for greater than R100 million, the scale of the plant – roughly 19 rugby fields – boggles the thoughts, and but it was constructed inside seven months, producing a complete 127 jobs, with 100 of them stuffed by individuals who dwell in Sedibeng. The job alternatives included technicians, development groups, basic employees and folks from the group who attend to photo voltaic panel cleansing and vegetation management to ensure the plant performs at its finest.

However by far essentially the most uncommon downside encountered have been the quite a few snakes, together with some venomous species, that had made the location at Sedibeng their dwelling.

Heineken says it tried to relocate the snakes as shut as doable to their pure habitat and none of them have been harmed. Among the many snakes have been Night time Adders, Rinkhals, Aurora, Noticed Skaapstekers, in addition to Pink-Lipped, Mole and Brown Home snakes.

Whereas this state of affairs could also be heaven to somebody like famed tattooed snake catcher Simon Keys, whose Snakes within the Metropolis programme enthralls viewers on DStv on a weekly foundation, the identical can’t be stated in your common particular person, whose pores and skin crawls on the mere point out of our slithering buddies.

And but Heineken and Sola ensured all of the snakes have been safely moved to adjoining Heineken land away from the photo voltaic PV trackers and workers and development groups.

Such interventions by corporations like Heineken are to be welcomed, and it’s crucial that others with large stability sheets additionally begin methods to extend their renewable vitality initiatives, particularly if we need to go away a sustainable world to future generations.

It will be significant that when launching a majority of these tasks, the natural world are left as untouched as doable. It additionally means carrying lengthy pants, socks and protecting clothes, and being looking out for the odd snake or two within the grass.

What’s there to say?

Optimistic price range, advanced nation

Both Finance Minister Enoch Godongwana is unfamiliar with the (probably apocryphal) story of Boris Yeltsin and John Main, or he’s a grasp of subtext.

The story goes like this: someday within the mid-Nineties, Main, then British Prime Minister, requested Yeltsin, then Russian President, to explain that nation’s financial system in a single phrase.

“Good,” Yeltsin reportedly stated.

“And in a couple of phrase?” Main requested.

Pause. “Not good,” Yeltsin replied.

Yeltsin’s dry response was not with out context, in fact. Revolutions, as a couple of scholar has identified, spark a brief crash in state capability and establishments, presenting a usually small window throughout which legislators can implement structural reforms and cement longer-term political and financial stability. Spoiler: normally, they do not. The outcomes are repented at leisure.

Quick ahead to SA in 2022. The medium-term price range coverage assertion, delivered on Wednesday, drew largely uniform responses from analysts: a tone of cautious optimism sealed with greater than just a little wariness. Working with windfalls, plugging a number of the proper holes. Godongwana is strolling the tightrope effectively, however it’s nonetheless a tightrope.

So the minister, whether or not he realised it or not, delivered a slightly extra layered response than he supposed when was requested to explain the medium-term price range coverage assertion final week and he gave that one-word reply: “constructive”.

Perhaps, Minister. However the bar can also be fairly low at this level. And with so many weighty questions left unanswered in the long run, it is simply as effectively no one requested for a couple of phrase.

What are the tax revolt metrics?

Taxes might be thrilling, you already know

It might be unfair to say the medium-term price range coverage assertion final week was filled with causes to press forward with a tax revolt. SA’s debt-to-GDP is trying higher than anticipated (thanks mining sector), there have been no nasty surprises by way of tax hikes, and there are indicators of observe by means of on state guarantees of fiscal consolidation, in addition to combatting monetary crimes (why pay your charges and taxes in case your native politicians don’t and probably, allegedly, even on the highest stage).

As a substitute, SA obtained a sober evaluation and reliable statistics, in addition to grateful prayers by not less than some that native politics doesn’t appear to be setting the stage for a macroeconomic surroundings comparable to Sri Lanka’s, or Turkey’s.

However how are issues actually trying?

In keeping with this fascinating journal article (which does appear to err at one level; SA isn’t among the many prime ten international locations with the best tax-to-GDP ratios) these on tax revolt watch ought to think about 5 elements, specifically: excessive unemployment, extreme tax burden, excessive inequality, excessive inflation and excessive indebtedness.

Inequality is hard, as recent gini statistics are onerous to return by (the price range defines this, however then would not point out it). However issues did get just a little higher between 2001 and 2018 (whereas nonetheless remaining terrible), in keeping with a 2022 World Financial institution report on the problem. That report went on to notice, nevertheless, that in SA social grants are a serious mechanism of lowering it. So, the continuation of social aid of misery grant, 7.4 million folks, ought to assist.

Extreme tax burden? An ongoing difficulty for certain for SA’s tiny tax base, non-public well being, non-public safety, non-public schooling and many others … however hardly might be stated to be worsened by the price range, although quickly rising utility prices, at the same time as supply stays erratic, generates loads of anger and repair supply protests.

Excessive inflation? Yup, however it peaked in July, it appears (aside from meals, worryingly). It is usually hardly the federal government’s fault; it’s a world difficulty, although that will not assist a lot.

Excessive indebtedness? Trickier – there are troubling indicators, comparable to lenders tightening their standards, and debt appears to be selecting up. Many have famous the shocking resilience of the buyer in 2022, although, and the Reserve Financial institution stated in October that money and deposits held by households have been effectively above the averages of the previous decade, and replicate the nonetheless unspent transfers acquired throughout Covid-19.

Unemployment? Higher, if nonetheless tear-your-hair-out excessive – 33.9% within the second quarter, a 0.6 proportion level enchancment. Though a light labour market restoration might happen within the close to time period, medium-term prospects for employment development stay weak, limiting private earnings tax projections, the Treasury says.

So general the developments do not look that unhealthy, or not less than the unhealthy stuff within the developments is not that new, scary maize and vegetable oil costs apart. However then, why speculate on one large tax revolt when there are profitable ongoing tax revolts? Gauteng motorists appear to have gained their battle over e-tolls, although not formally, however it does appear the writing is on the wall. I imply, actually, attempt get folks to pay for e-tolls. Gauteng Premier Panyaza Lesufi has thrown his backing behind Soweto residents not paying for electrical energy, and Eskom has been writing off a few of that debt already. Helen Zille can also be accessible to throw luggage of electrical energy payments into Cape City harbour (principally), if the corruption image would not begin trying a bit higher, whereas there’s additionally commerce union Solidarity, who additionally thinks governments needs to be afraid of their folks.

So, there are some excessive profile choices for tax revolt leaders, not less than, however a quick have a look at the numbers and the tone of the price range does appear to counsel that, general, the problem of individuals not paying for stuff will stay the place it belongs – on the poll field.

The lights maintain going out, although, and with the federal government more and more trying like it is going to want proceed to reshuffle that SOE debt, from state assured debt into simply state debt, who is aware of. It does appear that the federal government might want to observe by means of on its guarantees to sort out corruption, nevertheless, as whereas many could also be keen to render unto Caesar, few need to render unto Nero.

Quote of the day

Tweet of the day

Minister Godongwana we really recognize the way you respect negotiations. Can we safely assume that the Soweto Eskom Electrical energy debt and that of different townships can also be scrapped as per our intensive foyer? To start out creating townships the debt should additionally go.

— Panyaza Lesufi (@Lesufi) October 27, 2022

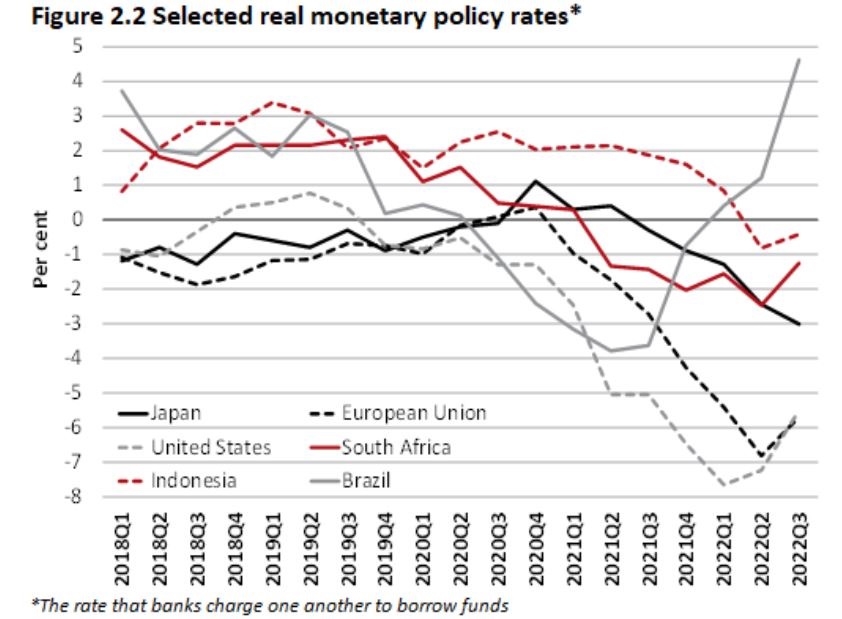

Chart of the day

Numbers of the day

10 billion

Variety of Pink Bull cans bought in 2021, a couple of per particular person on the planet. The Swiss firm’s income jumped 24% to 7.8 billion euros. (Bloomberg)

Beforehand:

STOCK TAKE | In reward of SA’s nice worriers

STOCK TAKE | Eskom (form of) stimulates enterprise spending, whereas tremendous yacht heads SA’s means

STOCK TAKE | Telkom will get jilted and Markus 2.0

STOCK TAKE | The Dis-Chem drama – and Decide n Pay hunch factors to hassle forward

STOCK TAKE | A story of two smelters, and did banks get it mistaken on dwelling loans?

STOCK TAKE | Reserve Financial institution walks the hawk speak and Concord re-emerges down beneath

STOCK TAKE | Allan Grey takes shine to Gold Fields – and Anglo’s Kusile-sized generator

STOCK TAKE | Decide n Pay’s large guess – and must you observe Gerrie?

STOCK TAKE | Is Sasol’s hydrogen plan simply scorching air?

STOCK TAKE | Karooooo grows its Os and Ackerman states it like it’s

STOCK TAKE | A German treatment for SA labour woes – and what’s Schadenfreude in Swedish?

STOCK TAKE | Allan Grey takes shine to Gold Fields – and Anglo’s Kusile-sized generator

STOCK TAKE | Telkom avoids sign loss amid the Rain – and the Woolies wage means

Information24 encourages freedom of speech and the expression of numerous views. The views expressed on this column don’t essentially characterize the views of News24.

[ad_2]